Gain Full Control of Customer

Experience

The smart solution to measure, analyze, and optimize customer flow across branches and digital channels.

Trusted by 4,000+ companies.

Queue Analytics Software

Optimize Queue and Service Management

Spectra provides modular software to monitor queues, appointments, and

customer flow—delivering real-time insights to reduce waiting times and boost

satisfaction.

Turn Data Into Insights

Spectra empowers organizations to monitor customer flow, optimize service

operations, and make smaller, data-driven decisions in real time.

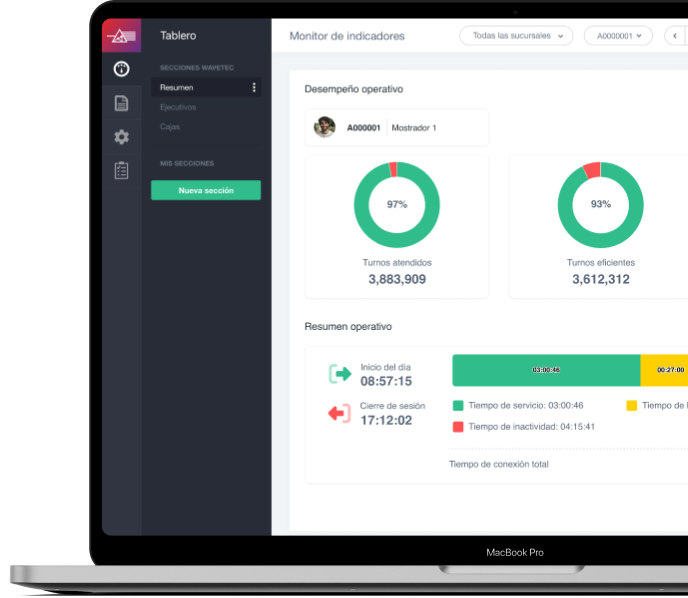

Real-Time Monitoring

Track queues, service times, and staff performance through intuitive dashboards and live performance indicators.

Seamless Integration

Connect easily with queue systems, CRMs, and BI tools to centralize and analyze all customer journey data.

Flexible Deployment

Deploy Spectra on-premise or in the cloud to fit your organization’s infrastructure and security needs.

Key Features & Capabilities

Comprehensive Queue Analytics

Gain visibility into every service touchpoint. Spectra captures real-time data on waiting times, service durations, and customer flow—helping managers identify bottlenecks and optimize performance across branches and digital channels.

Customizable Dashboards

Build interactive dashboards with metrics that matter to your business. Visualize KPIs, compare branch performance, and export reports instantly to improve decision-making and operational transparency.

Advanced Reporting Engine

Generate detailed reports with automated scheduling, trend analysis, and performance benchmarking. Spectra turns raw queue data into actionable intelligence for continuous service improvement.

Multi-Channel Integration

Integrate seamlessly with Wavetec queue systems, appointment modules, feedback kiosks, CRMs, and BI tools—ensuring consistent data across all service environments.

Cloud or On-Premise Deployment

Choose the deployment model that best fits your infrastructure and compliance needs. Both options offer secure access, scalability, and minimal IT maintenance.

Benefits & Outcomes

Reduced Waiting Times

Organizations using Spectra have reported significant reductions in average waiting times by streamlining service allocation and resource planning. CITATION NEEDED

Enhanced Customer Satisfaction

Real-time insights enable faster responses to service delays and customer feedback, leading to measurable improvements in satisfaction and loyalty scores. CITATION NEEDED

Improved Operational Efficiency

Managers gain actionable data to optimize staffing, identify performance gaps, and enhance throughput across service locations.

Data-Driven Decision Making

Centralized analytics empower teams to make evidence-based decisions that align customer experience with organizational goals.

Increased Employee Productivity

Transparent metrics and performance visibility help motivate teams and ensure fair workload distribution across counters or service points.

Where Spectra Makes an Impact

Banking & Financial Services

Monitor queues, teller efficiency, and customer flow across branches to reduce waiting times and improve performance.

Healthcare & Hospitals

Enhance patient experience by tracking wait times, managing appointments, and optimizing staff schedules across departments.

Government Services

Streamline citizen services and improve public satisfaction using real-time queue insights and performance reporting.

Telecom & Retail

Analyze customer traffic and service durations to optimize store operations, reduce congestion, and improve customer experiences.

Education & Universities

Improve student service centers and administrative processes by monitoring queues, appointments, and support desk performance.

Hospitality & Travel

Enhance guest experience and operational efficiency by managing check-ins, reservations, and service queues across hotels and airports.

Wavetec’s queue management solutions have significantly improved our customer experience by reducing wait times and optimizing service efficiency.

Delte Air Lines

Wavetec’s queue management solutions have significantly improved our customer experience by reducing wait times and optimizing service efficiency.

Delte Air Lines

Wavetec’s queue management solutions have significantly improved our customer experience by reducing wait times and optimizing service efficiency.

Delte Air Lines

Frequently Asked Questions

Everything you need to know about the solution.

Wavetec allows banks to monitor customer wait times, transaction throughput , appointment adherence, and satisfaction metrics , providing real-time dashboards to optimize branch efficiency and customer experience

Yes, you can try us for free for 30 days. If you want, we’ll provide you with a free, personalized 30-minute onboarding call to get you up and running as soon as possible

Yes, you can try us for free for 30 days. If you want, we’ll provide you with a free, personalized 30-minute onboarding call to get you up and running as soon as possible

Yes, you can try us for free for 30 days. If you want, we’ll provide you with a free, personalized 30-minute onboarding call to get you up and running as soon as possible

Yes, you can try us for free for 30 days. If you want, we’ll provide you with a free, personalized 30-minute onboarding call to get you up and running as soon as possible

Still have questions?

Can’t find the answer you’re looking for? Please chat to our friendly team.