In this blog: We discuss how pandemics were handled in the past and how they shaped our preparedness for future crises like the one we face today and how & why organizations today are better equipped to deal with the Covid 19 crisis by leveraging alternate channels of service delivery and other technologies.

The Covid 19 Pandemic adversely affected almost every kind of business and most industries during its first few months. No one expected it to spiral out of control the way it did and engulf everything in its path.

Studying the Past

There aren’t many recorded cases of anything quite like the Corona Virus in the history of the world. As of June 2021, this pandemic has resulted in over 3.7 million deaths worldwide. Yes, the Spanish Flu did kill nearly 50 million people all over the globe, but that was over a century ago when hygiene wasn’t top priority and population density was extremely high.

3.7 million deaths is a shocking amount when you consider how far medicine and technology have come. For perspective, the 2003 SARS Corona Virus pandemic killed less than a thousand people and the Swine Flu was believed to have resulted in 200,000 deaths at most.

The most comparable events to the current pandemic were perhaps the Asian flu and the Hong Kong flu which resulted in the demise of over two million people combined between 1957 and 1970. The Asian flu drew a parallel to Covid 19 in a capacity that most of its victims were above the age of 65 while the Spanish and Swine flu almost exclusively targeted young and healthy individuals below the age of 65.

Lessons from History

While most businesses suffer a great deal financially during such events due to loss of human capital, history tells us that there are always opportunists who manage to profit during these economic slumps. According to the HBR, 14% of large businesses managed to increase their sales growth and EBIT margin during the last four economic downturns.

Another lesson from the past is that historic events of such magnitude change the world forever; they leave a lasting impact even after they have ended along with the temporary changes they bring and take with them. The 2009 H1N1 pandemic helped develop a tool known as the Pandemic Severity Assessment Framework which has since helped public health professionals make well informed decisions in a timely manner.

Past pandemics like the Spanish flu generally helped the world prepare for future pandemics. After the devastation of the 1918 Spanish flu pandemic the world assessed and reevaluated its policies and procedures in pandemic preparedness. Frequent conferences and meetings were held since then to constantly reevaluate policies and practices to be better prepared in case of another virus outbreak.

Why do you think the CDC recommends everyone get an annual flu vaccine?

Economic Impact

People like to blame the pandemic for halting economic activity, but it wasn’t the virus that directly shut down businesses, it was our response to the virus. The lockdowns were imposed in the interest of public health, along with other mandatory practices like mask wearing, curfews and social distancing.

This is the first time a pandemic had been dealt with by imposing lockdowns and shutting down all non essential businesses. All former virus outbreaks were kept at bay by implementing distancing and handwashing policies. To be fair, none of these previous pandemics were of the same magnitude.

All past pandemics were followed by at least a mild economic slump where as the Spanish flu, combined with the consequences of the recently concluded world war, was followed by a serious recession. Similarly, the Covid 19 crisis sent the economy into a downward spiral.

Ups & Downs in the Index

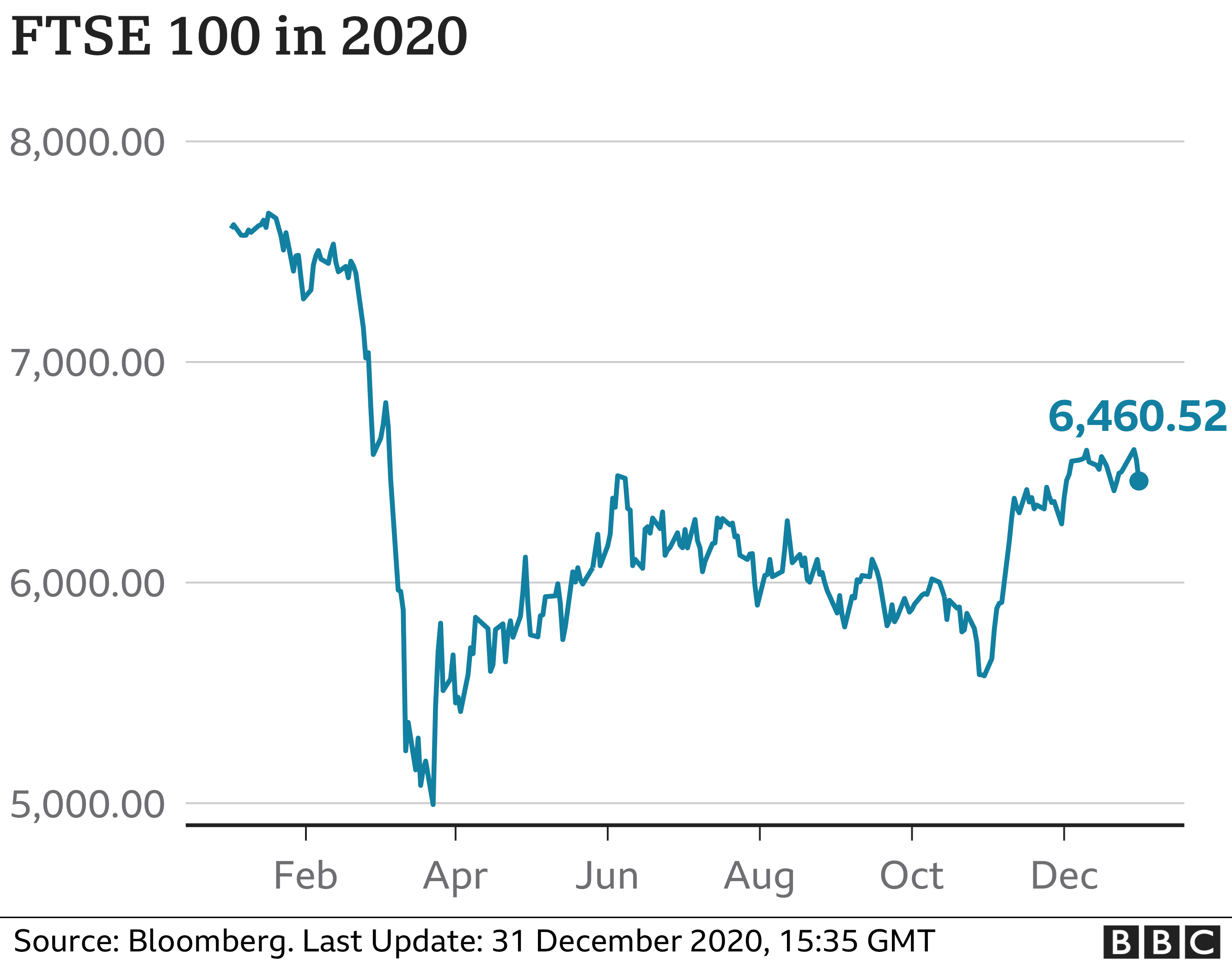

In the first months of the Corona Virus, the FTSE, Dow Jones, Nikkei all suffered greatly and have only recently started recovering after the rollout of the vaccines. The FTSE, however, is still in the negative territory. In fact, the FTSE experienced its worst year since the global financial crisis.

Most economies went into recession reporting dips in GDP growth of as low as negative 70%. On the other hand, China was the only major economy to show growth during this period; reported 2.3%. The tourism industry has also suffered a loss of billions in 2020 and things aren’t expected to return to normal until at least 2025.

The IMF estimates that the global GDP fell by 4.4% which is the worst recorded decline since the Great Depression of the 30s. However, positive growth is predicted for the year 2021; a global GDP growth of 5.2% driven primarily by China and India.

Big Pharma gets Bigger

Pharmaceutical companies were among the few who stayed on top during the pandemic. Their product was constantly in demand and after the approval of their vaccines, companies like Moderna, AstraZeneca and Novavax have seen significant rises in their stock prices. Moderna’s share value increased by a surprising 715% during the pandemic.

Companies like Johnson & Johnson and GSK have also developed vaccines that have been approved and are rolling out to the public. These organizations are also expected to see a significant rise on the stock market.

A Unique Situation

With the Covid 19 pandemic, we faced a very unique situation unlike past crises. This time, the world was equipped with better technology, modern medicine and proven business methods; this time the world was better equipped to deal with this god awful situation.

The healthcare industry was prepared to deal with the oncoming onslaught of Covid patients and within a year we had multiple approved vaccines rolling out to essential workers and then civilians. This rapid development of the vaccine has allowed the world to start returning to normal only a year after the first cases.

Everything Goes Remote

Within the first month of the Covid 19 crisis we knew that it would be a while until things would go back to normal. Educational institutions were among the first to employ remote working technologies like Skype and Zoom to carry on the academic year so students don’t have to delay their academics.

Remote working became the norm for most workplaces and offices soon after the first few weeks of the pandemic. It was certainly difficult to adapt and this new work dynamic presented unique challenges to everyone; some suffered technological hurdles, others had connectivity issues while all almost all of us took a blow to our mental health.

There is no debate that technology carried us through the Covid 19 crisis and kept the global economy afloat during this torrid time in human history.

Nonetheless, we overcame and are more prepared than ever for, God forbid, another pandemic.

But what about businesses with products and services to sell? How did they deliver their offerings to their customers?

What’s an ADC?

ADCs or alternate delivery channels enable businesses and service providers to extend their reach far beyond that which they would achieve with traditional channels of product and service delivery. I don’t suppose there is a single business that hasn’t made use of ADCs during this crisis.

Some examples of ADCs employed by businesses during the pandemic include online shopping, electronic/mobile banking and the use of self service technologies. ADCs allowed businesses to carry out a digital transformation during the Covid crisis to continue serving customers remotely or through alternate mediums.

Shopping goes Digital

Online shopping flourished throughout the Corona crisis and has become the norm for most shoppers today. Consumer trends have changed drastically and according to a study by EY, 67% customers are not willing to travel further than 5km for shopping, 76% preferred paying via touchless mediums like mobile wallets and 78% preferred using self checkout kiosks.

In January this year, shopper footfall fell by 97% in Germany compared to the same time last year. This means that almost all shopping has gone online in Germany. The trends are very similar in other nations in the same region; shopper footfall fell by 78% in the UK and by 67% in Italy.

Shoppers are more paranoid than ever stepping out for a trip to the shops or the mall and rightly so. Online retail flourished in 2020 and clocked a shocking $3.9 trillion in revenue in 2020.

ADCs Were Already Commonplace

This may be a bit surprising but the use of ADCs is nothing new; financial service providers have been steadily growing their implementation and use of these alternate channels so much so that over 60% of FSPs were using ADCs to enrich their customer experience and expand their network of branches in 2018.

ADCs are meant to drive business efficiency and enable convenient customer journeys while diversifying traffic through different channels of service delivery. Banks had ATMs so customers could skip queues at branches and withdraw sums of money outside of banking hours.

Leading Industries

In the last few years banks invested in more self service technologies and bank digitization efforts to empower customers to carry out their own transactions. These efforts gave us cash deposit machines, check deposit kiosks and card issuance machines which essentially automate all the functions of a physical branch from depositing cash to opening a new account and issuing a new debit card.

Similarly, retail outlets, supermarkets & quick service restaurants (QSRs) have also invested quite a bit in self service technologies. A lot of the larger supermarkets and QSRs have installed self checkout systems and self ordering kiosks in conjunction with conventional checkouts and order counters to enrich customer experience by offering choice and convenience.

Telecommunication companies have also been on the forefront of self service technology innovation with the use of SIM dispensing kiosks and mobile wallet integrations. These kiosks are also capable of new customer onboarding and full KYC registration, hence they can fully replace telecom service centers saving costs in the long run and enhance customer journeys while expanding their network of sales & services through ADCs.

Although ADCs have been commonplace, consumer sentiments towards them have changed during the pandemic. Before, it was a slight inconvenience if banks didn’t have cash deposit machines, but post-pandemic it has become a necessity for customers, a make or break factor when choosing a bank.

From Secondary to Primary

Before the Covid 19 pandemic, online shopping and home deliveries were also a norm, but it was still taken for granted until delivery drivers became essential workers and online and touchless channels became the primary medium driving sales.

Someone who would have once thought twice before using a self service kiosk will now almost definitely prefer self service over going inside a store or branch. Someone who once carried cash now only uses their mobile wallet to tap and pay.

Coping with the Crisis

During the initial lockdowns, companies were forced to shut down their physical stores and branches and in some regions even online channels were halted. This means banks, service centers, supermarkets, restaurants, and so on. Soon however, essential services like general stores were allowed to resume operations with strict SOPs.

Online businesses were also allowed to resume soon after the first two weeks and in some nations they never stopped. At this point, companies that had invested in ADCs like self service kiosks and online apps/portals were the only ones able to operate effectively and keep serving their customers.

ADCs became the main source of service delivery for some time and customers adapted to these new workflows. On the other hand, businesses that relied on in person interaction and physical stores for their service delivery suffered greatly. It wasn’t their fault because the Covid 19 crisis came without any notice.

However, they had control over what they did next. So most large and small organizations alike paid close attention to what was and wasn’t working during this time so they could better equip their business for the future. After witnessing the success of ADCs in a time of global crisis, any business that could went all in on ADCs.

Present ADC Landscape

Today, a year and a half after all the devastation, the landscape of ADCs is very different to what it was during the initial lockdowns. Infrastructure was modified and upgraded to support more digital transactions and the overall limits on online transactions through mobile wallets or cards have nearly doubled to facilitate and promote ADCs.

These policy and infrastructure changes are important because they facilitate smaller businesses to be able to stay afloat during these tough times and they’re important for customers too, customers who want to prioritize the heath and safety of themselves and their loved ones.

Consumer behavior surveys and statistics all suggest that customers understand the benefits of using ADCs; in terms of health & safety and convenience as well. Most customers say that they will continue using alternate channels like self service even after the world returns to normal. ADCs are the present and the future of an effective omnichannel experience.

No Going Back

A plethora of studies and research have been conducted around Covid 19 and its impact on different industries and the world in general. What has become evident from all the findings of the studies is that ADCs are here to stay. B2B sales statistics are very telling; 90% B2B sales have moved to remote selling and 70% are believed to retain some form of remote selling even when everything returns to normal.

Learning From a Crisis

This crisis presented an opportunity to many businesses to take a step back and reevaluate their strategies and approach to be drive more sustainable growth for years to come. Everyone is in the process of or has implemented an omnichannel approach to selling with a combination of in store, remote and digital sales.

There is simply no room for organizations with a myopic mindset still relying on traditional channels for selling. They will slowly be phased out of the market if they aren’t able to compete.

The Future of ADCs

It is still unclear how long we will be living with this virus despite the widespread rollout of vaccines. It seems that there is a new strain of the virus every time things are settling down again. Medical professionals believe that the Corona Virus will be a permanent installation in our lives as a seasonal flu that you have to get a shot for annually or bi-annually.

This is based off how the 2009 swine flu still circulates every year causing illness and even death. All we hope is that it doesn’t mutate to become more deadly like the H3N2 Hong Kong virus. In any case, the virus is here to stay which means we will see a lot of innovation in ADCs and more and more industries adopting alternate channels of service delivery.

Banks and financial service providers have spearheaded the digital transformation movement trying to completely digitize banking and the provision of financial services to future proof the industry and cement their place in the industry.

Should You Invest in ADCs?

Short answer: Yes, absolutely. Creating an omnichannel experience for your customers is a must because that is what they expect now, they expect you to be present everywhere they are; on their phones, their computers, social media, the web, and within close proximity to their physical location as well.

The case for ADCs is already made and the research and their findings speak for themselves. The only question for you is which ADCs to implement. Research based on your industry can help you decide whether it would be more beneficial for you to develop an application or use social media.

However, if you are responsible for a larger organization like a telecom service provider or a bank, it may be more suitable for you to reach out to industry professionals or self service solutions providers to get the best ADC solution that fits the requirements of your business.

Azimut Self Service

Azimut is a self service solutions provider that focuses on bringing you the best end to end solutions available in this ever growing industry. Azimut is part of the Wavetec Group, serving some of the largest banks, telecoms and mobile financial services providers in North America, Africa, and Central & Southeast Asia.

{{cta(‘9f8b6711-18a0-4978-8fab-74d5273885a4′,’justifycenter’)}}

BOOK A FREE DEMO