Comprehending Customer Lifetime Value (CLV) is essential for businesses that aim to maximize profitability and advance long-lasting customer relationships.

CLV measures the total revenue a customer is expected to bring over their relationship with a business rather than focusing solely on individual transactions.

This comprehensive approach helps businesses prioritize efforts to retain high-value customers, optimize their marketing strategies, and ultimately increase revenue growth.

Conducting a thorough customer lifetime value analysis can help companies identify trends, allocate resources efficiently, and tailor their approach to meet customers’ needs.

Its lifetime value through CLV marketing, loyalty programs, or personalized experiences can be a game-changer for sustainable growth.

In this article, we’ll explore CLV, the differences between historical and predictive CLV, its importance for businesses, methods for calculating it, and strategies to improve it. We’ll also explore how businesses can leverage Customer Lifetime Value models to ensure long-term success.

What is Customer Lifetime Value (CLV)?

Customer Lifetime Value (CLV) is a critical metric that estimates the total revenue a business can expect from customers throughout their entire relationship with the company. This metric is critical for understanding customer profitability and guiding strategic business decisions.

The lifetime value of a customer helps companies identify how much to invest in acquiring new customers and retaining existing ones.

Significance of CLV

Customer Lifetime Value is significant because it provides a comprehensive view of a customer’s potential revenue over time.

Businesses focusing only on short-term sales may need to pay more attention to retaining customers who could deliver much higher value in the long run. With a clear understanding of CLV, businesses can allocate resources more effectively and develop strategies that drive sustained growth.

For example, companies can identify their most valuable customers and design marketing campaigns targeting these high-value segments. This approach maximizes long-term customer value and increases the efficiency of marketing efforts.

How CLV Measures Revenue Generation?

Unlike metrics focusing on customer satisfaction or loyalty, such as the Net Promoter Score (NPS) or Customer Satisfaction Score (CSAT), Customer Lifetime Value is directly linked to revenue.

While NPS and CSAT measure how likely customers are to recommend the business or how satisfied they are, CLV provides a tangible financial perspective by estimating the actual revenue a customer will likely generate. This makes it an essential metric for businesses aiming to optimize profitability.

Historical vs. Predictive Customer Lifetime Value

Historical CLV

Historical Customer Lifetime Value assesses a customer’s total revenue based on past transactions. It provides insights into how much value a customer has already delivered to the business, making it useful for evaluating the effectiveness of past marketing efforts and customer retention strategies.

For instance, a subscription-based service may analyze a customer’s total spending over the last two years to determine their historical CLV.

However, historical CLV has its limitations. While it shows past behavior, it does not account for changes in a customer’s preferences, market conditions, or external factors that could affect future spending. Relying solely on historical data may lead businesses to overlook evolving customer needs.

Predictive CLV

Predictive Customer Lifetime Value, on the other hand, uses historical data to forecast a customer’s future revenue potential.

It leverages statistical models and machine learning algorithms to predict future buying behavior based on purchase frequency, average order value, and customer engagement.

When understanding a customer’s potential future value, companies can make proactive decisions to improve customer relationships.

For example, a business might use predictive CLV to identify customers likely to spend more in the next year and target them with special offers or personalized recommendations.

This approach enables companies to anticipate customer needs and optimize marketing strategies to increase the lifetime value per customer.

How CLV Differs from Other Metrics

Customer Lifetime Value (CLV) stands out from other customer-related metrics due to its focus on revenue generation. Here’s how CLV compares to metrics like Net Promoter Score (NPS) and Customer Satisfaction Score (CSAT):

• Net Promoter Score (NPS): Measures customer loyalty by asking how likely customers are to recommend the business. While NPS indicates how satisfied customers are, it does not directly correlate to the financial value customers bring to the business. In contrast, CLV provides a direct link to revenue, enabling businesses to assess the profitability of retaining a customer.

• Customer Satisfaction Score (CSAT): This score evaluates customers’ satisfaction with a specific interaction or purchase. While CSAT is valuable for understanding customer experiences, it does not provide insights into the long-term revenue a customer may generate. CLV marketing strategies focus on increasing the overall revenue from each customer rather than just satisfying them at the moment.

The key distinction is that while metrics like NPS and CSAT measure customer lifetime management aspects, such as loyalty and satisfaction, CLV provides a financial perspective, allowing businesses to focus on strategies that maximize revenue over time.

The Importance of Customer Lifetime Value for Your Business

Understanding the lifetime value of a customer is crucial for businesses aiming to achieve long-term growth and profitability.

Customer Lifetime Value (CLV) provides a comprehensive view of the financial potential of customers, guiding strategic decisions across various functions such as marketing, sales, and customer service. Here are the key reasons why measuring CLV is vital for business success:

1. Cost Savings

Knowing a customer’s lifetime value helps businesses allocate resources more effectively, potentially reducing acquisition costs.

Companies can identify which customers are worth investing in and focus their marketing efforts on retaining these high-value customers instead of continuously acquiring new ones. Here’s how this leads to cost savings:

• Optimized Marketing Budgets: Businesses can prioritize marketing campaigns targeting customers with a high CLV, as these customers will likely bring more revenue over time. This ensures marketing budgets are spent on strategies that generate the best returns.

• Efficient Resource Allocation: By focusing on retaining high-value customers, companies can reduce the costs associated with frequent customer acquisition, such as ad spend and sales commissions.

For example, subscription-based companies often use customer lifetime value analysis to identify subscribers likely to stay longer. Offering targeted incentives or loyalty rewards to these subscribers can extend the customer’s lifecycle and reduce the need for costly acquisition efforts.

2. Identifying Attrition Risks

Tracking Customer Lifetime Value can help businesses detect patterns that indicate customer churn, allowing proactive measures to be taken to retain these customers. If a customer’s predicted CLV declines, it may signal dissatisfaction or an increased likelihood of leaving for a competitor.

Companies can use this insight to address potential issues early, preventing revenue loss. Here are some ways businesses can identify attrition risks using

CLV:

• Monitoring Engagement Trends: Decreased purchase frequency, lower average order values, or reduced engagement can indicate a decline in long-term customer value. Identifying these trends can help companies take corrective action, such as offering personalized discounts or reaching out to understand customer concerns.

• Segmentation Analysis: Analyzing CLV by customer segments can reveal which groups are most at risk of churning. For instance, customers who joined during a promotional period may have a lower lifetime value if they were primarily motivated by discounts.

When identifying potential churn risks, businesses can implement strategies to improve retention, such as enhancing customer support, refining product features, or offering re-engagement campaigns.

3. Finding High-Value Customers

Figuring out Customer Lifetime Value enables businesses to identify which customers are most profitable and have the potential for high long-term customer value.

When analyzing CLV models, companies can discover the traits and behaviors that characterize high-value customers, such as spending patterns, purchase frequency, or preferred product categories. Here’s how businesses can leverage this information:

• Targeted Marketing Campaigns: Once a company understands the profile of its most valuable customers, it can replicate successful marketing tactics to attract similar prospects. For instance, a luxury brand may focus on customers who have previously purchased high-end products, offering personalized promotions to encourage repeat purchases.

• Enhanced Personalization: Knowing a customer’s lifetime value allows businesses to customize interactions based on that value. High-CLV customers can receive priority service, exclusive offers, or personalized recommendations, all of which help strengthen their loyalty.

For example, companies like Amazon use data-driven approaches to segment customers based on their lifetime value analysis, tailoring email promotions and recommendations to encourage additional purchases.

This targeted approach not only increases customer satisfaction but also maximizes revenue.

4. Strategic Decision-Making

Interpretation of Customer Lifetime Value guides strategic business decisions across multiple areas, including marketing, sales, and product development. Here’s how CLV can influence strategic planning:

• Marketing Investment: Businesses can determine how much to invest in acquiring new customers by comparing Customer Acquisition Cost (CAC) to CLV. A higher CLV-to-CAC ratio indicates a more profitable customer relationship, justifying increased marketing investment to acquire similar customers.

• Product Development: Insights from lifetime value analysis can help companies identify which products or services drive the most value. For example, if customers with a higher CLV frequently purchase a particular product, the company may choose to develop complementary products to increase purchase frequency.

5. Enhancing Customer Experience

CLV marketing strategies are focused on maximizing customer revenue over time, often requiring a superior customer experience.

When understanding Customer Lifetime Value, companies can prioritize improving touchpoints that have the most impact on retaining high-value customers. Consider these benefits:

• Personalized Interactions: High-CLV customers can be targeted with personalized content, recommendations, or offers that cater to their preferences, enhancing the overall customer experience. For example, a hotel chain may offer customers free room upgrades or late checkouts with a higher lifetime value.

• Resource Allocation to High-Value Customers: Businesses can ensure that their best customers receive top-notch support and engagement when focusing on customers with high CLV. This might include dedicated account managers, priority access to new products, or exclusive events.

6. Supporting Sustainable Growth

Businesses that use Customer Lifetime Value models to inform their strategies can drive sustainable growth by consistently increasing the lifetime value per customer. Here’s how CLV supports long-term success:

• Higher Profit Margins: Since retaining existing customers is generally less expensive than acquiring new ones, focusing on CLV marketing can help businesses achieve higher profit margins.

• Long-Term Planning: Knowing the expected lifetime value of a customer allows companies to make more accurate long-term revenue forecasts, helping them plan for future investments or expansion.

7. Competitive Advantage

Businesses that effectively manage their Customer Lifetime Value gain a competitive edge by focusing on customer relationships that yield the highest returns. Companies that prioritize CLV can outperform competitors by:

• Maximizing Marketing Efficiency: Businesses can reduce wasted marketing spend and achieve better campaign results when targeting high-value customers and prospects.

• Building Strong Customer Loyalty: Focusing on customers with a high CLV helps build a loyal customer base that is less likely to switch to competitors. The more a company invests in its most valuable customers, the stronger the brand loyalty.

How to Calculate Customer Lifetime Value (CLV)?

Calculating Customer Lifetime Value involves understanding the components contributing to a customer’s total worth. A simple formula to calculate CLV is:

CLV = Average Purchase Value × Average Purchase Frequency × Customer Lifespan

Explaining Each Component

1. Average Purchase Value: The typical amount a customer spends per transaction. For example, if a customer spends $50 per purchase, that is the average purchase value.

2. Average Purchase Frequency: The frequency at which a customer makes a purchase over a specified period. For example, if a customer buys five times a year, the frequency is 5.

3. Customer Lifespan: The duration of a customer’s continued purchasing from the business. If a customer stays loyal for 3 years, the lifespan is 3 years.

So, if a customer spends $50 per purchase, buys five times a year, and remains loyal for 3 years, their Customer Lifetime Value would be:

CLV = $50 × 5 × 3 = $750

Key Factors Influencing Your CLV Calculation

Several factors can affect the accuracy of your CLV calculation, including:

• Customer Acquisition Costs: The cost of acquiring new customers should be subtracted from the total CLV to get a more accurate picture of profitability.

• Retention Rates: Higher retention rates increase the average customer lifespan, raising CLV.

• Seasonal Purchasing Behavior: Customers may spend more during specific seasons, affecting the calculation. For instance, retail businesses may see spikes during the holidays.

Using predictive analytics and machine learning, businesses can refine their lifetime value analysis to account for these factors and achieve more precise forecasts.

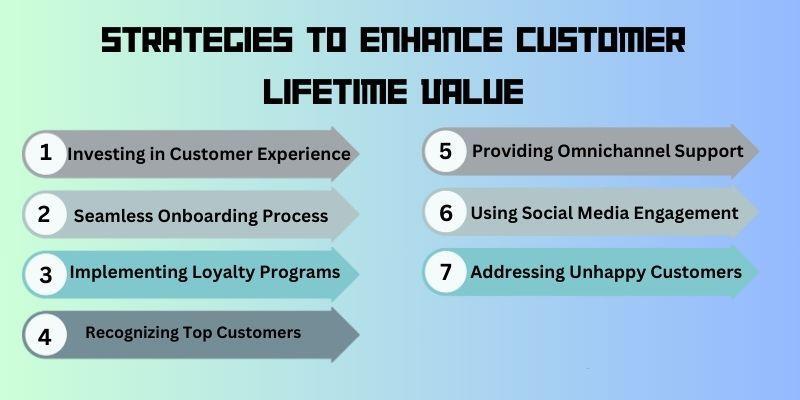

Strategies to Enhance Customer Lifetime Value (CLV)

Increasing Customer Lifetime Value (CLV) involves adopting strategies that retain customers and maximize their spending. Here are some practical approaches:

1. Investing in Customer Experience

Delivering a positive experience at every touchpoint is critical to boosting satisfaction and loyalty, increasing CLV.

Companies like Zappos are known for their exceptional customer service, which has helped them achieve high retention rates and significant long-term customer value. Businesses can ensure customers feel valued when focusing on personalized service and proactive communication.

2. Seamless Onboarding Process

A smooth onboarding process sets the stage for long-term customer engagement. When new customers quickly realize the benefits of a product or service, they are more likely to stay loyal.

Resources such as tutorials, training sessions, and user guides can help customers get the most out of the product, increasing their lifetime value.

3. Implementing Loyalty Programs

Loyalty programs encourage repeat purchases by rewarding customers for their continued patronage.

For example, Sephora and Starbucks use point-based systems where customers earn rewards for every purchase, motivating them to return. Such programs incentivize repeat business and boost the overall lifetime value per customer.

4. Recognizing Top Customers

Acknowledging high-value customers with personalized rewards or special recognition promotes loyalty and encourages continued engagement.

Personalized thank-you notes, exclusive discounts, or VIP events make customers feel special, motivating them to stay longer and spend more. This targeted approach can significantly boost CLV marketing efforts.

5. Providing Omnichannel Support

Consistent support across multiple channels, including social media, email, and physical stores, allows customers to interact with the business in the way that best suits them.

Omnichannel support adds to the customer experience, leading to higher satisfaction and increased Customer Lifetime Value.

6. Leveraging Social Media Engagement

Engaging with customers on social media helps build a community and creates more robust relationships. Companies that interact with customers on platforms like Twitter and Instagram maintain visibility and augment customer loyalty.

Social media can serve as a valuable tool for customer lifetime management, helping businesses increase CLV by addressing concerns and sharing valuable content.

7. Addressing Unhappy Customers Promptly

Resolving customer issues quickly can prevent churn and ensure a high lifetime value for a customer. Studies indicate that customers who experience prompt resolutions are more likely to continue their relationship with a business.

Companies can maintain customer satisfaction and maximize long-term value by focusing on quick, practical solutions.

FAQs

What are lifetime customer value examples?

Lifetime customer value examples include the total amount spent on a subscription service over five years or the total revenue generated by a customer who purchases products monthly for three years.

What is the ideal lifetime value of a customer?

There is no single ideal CLV; it varies by industry and business model. However, a high CLV relative to the customer acquisition cost indicates a healthy, profitable relationship.

What is a good CLV value?

A good CLV value depends on the industry average. Typically, a CLV to CAC ratio of 3:1 is considered strong.

What is the 80/20 rule in CLV?

The 80/20 rule suggests that 80% of a business’s revenue comes from 20% of its customers. This principle underscores the importance of focusing on high-value customers to increase CLV.

What are the disadvantages of customer lifetime value?

Disadvantages of CLV include potential inaccuracies in predicting future behavior and the complexity of calculating it accurately for businesses with diverse product lines.

Conclusion

Calculating and comprehending Customer Lifetime Value (CLV) is decisive for businesses that aim to maximize profitability and develop lasting customer relationships.

Companies can ensure a higher return on investment and long-term success by accurately calculating CLV and implementing strategies to increase it.

From CLV marketing to loyalty programs and personalized customer experiences, the possibilities for increasing the lifetime value per customer are extensive.

Businesses should continuously monitor their lifetime value analysis and seek ways to optimize their Customer Lifetime Value models. This will help them identify areas for improvement and prioritize efforts that lead to sustainable growth.

BOOK A FREE DEMO