Cash deposit machines (CDMs) have become essential in today’s fast-paced business environment, providing an automated solution for secure and efficient cash handling.

Increasingly adopted by industries like retail, hospitality, and banking, cash deposit machines streamline the process of depositing cash, minimizing the need to visit a bank in person.

These machines offer notable cash deposit machine benefits, including convenience, increased security, and operational efficiency.

However, like any technology, CDMs also come with their cash deposit machine drawbacks. While they provide a smooth cash management solution for many, they also raise concerns about operational errors, limited functionality, and potential fees.

In this article, we’ll explore the pros and cons of using cash deposit machines, helping businesses make informed decisions on whether CDMs align with their cash management needs.

What is a Cash Deposit Machine (CDM)?

A cash deposit machine (CDM) is an automated device that enables businesses and individuals to deposit cash directly into their bank accounts without needing assistance from bank staff.

Commonly located in bank branches, retail centers, and high-traffic commercial areas, CDMs provide a self-service option for cash deposits, available 24/7.

The primary function of a CDM is to automate the cash deposit process, reducing the reliance on traditional teller services. CDMs scan and count the cash, verify its authenticity, and deposit it into the designated account.

This automation makes cash deposit machine advantages clear, as businesses can efficiently handle cash without visiting a physical bank branch during operational hours.

Additionally, cash deposit machines improve cash flow management by recording deposits digitally, simplifying bookkeeping, and reducing errors commonly associated with manual cash handling.

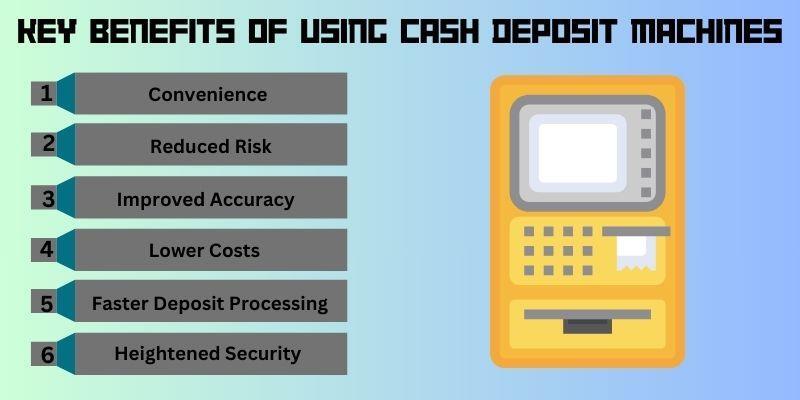

Key Benefits of Using Cash Deposit Machines

Cash deposit machines provide numerous benefits that can transform business cash management processes. Below, we’ll outline the main advantages of implementing CDMs in business operations.

1. Convenience

One of the top benefits of a cash deposit machine is convenience. CDMs allow businesses to deposit cash whenever they need, bypassing the need to wait in line at a bank. For companies handling cash regularly, this 24/7 access simplifies daily cash-handling tasks.

When using CDMs, businesses reduce the time spent on manual cash processing, allowing employees to focus on other tasks and improving overall operational efficiency.

CDMs’ accessibility and ease of use make them a valuable tool for businesses aiming to align their cash management.

2. Reduced Risk

A key cash deposit machine advantage is the reduced risk associated with cash handling. CDMs minimize the time cash remains on-site, allowing businesses to deposit funds securely and quickly.

This significantly reduces the risk of theft and loss, as cash is safely stored within the machine and deposited directly into the bank.

CDMs provide a secure alternative to storing large amounts of cash on-premises, improving overall security for businesses that operate in high-traffic areas or have extended operating hours.

3. Improved Accuracy

CDMs also offer improved accuracy in cash handling, minimizing human error. When automating the cash counting and deposit processes, CDMs reduce discrepancies that can arise from manual cash handling.

These machines provide digital logging of deposits, simplifying record-keeping and ensuring that deposits are accurately recorded. This cash deposit machine benefit is precious for businesses that handle large volumes of cash daily, as it supports accurate and efficient accounting.

4. Lower Costs

Another significant benefit of using a cash deposit machine is cost savings. When reducing the need for manual cash counting and handling, CDMs help businesses cut down on labor expenses.

Employees no longer need to spend time managing cash deposits manually, which allows businesses to allocate their workforce more effectively.

Over time, the cost savings associated with cash deposit machine advantages can significantly impact a company’s bottom line, particularly for businesses with frequent cash deposits.

5. Faster Deposit Processing

CDMs expedite the cash deposit process, especially during busy periods. In traditional banking, deposit transactions can be time-consuming, especially if there are long queues.

With a cash deposit machine, businesses can complete deposits quickly, enabling employees to focus on other essential tasks.

This cash deposit machine benefit is essential for retail and hospitality businesses, where quick service is essential to maintaining customer satisfaction.

6. Heightened Security

A significant advantage of a cash deposit machine is security. CDMs have advanced security features, including anti-tampering technology and secure storage for deposited funds, which protect against unauthorized access and theft.

The cash stored in a CDM is secure until it is collected by a cash-in-transit (CIT) service, providing businesses with peace of mind regarding cash safety.

This heightened level of security makes CDMs a reliable option for businesses focused on safeguarding their funds.

Potential Drawbacks of Cash Deposit Machines

While CDMs offer numerous benefits, cash deposit machines also have drawbacks that businesses should consider before adopting this technology. Recognizing these potential challenges can help businesses make informed decisions.

1. Vulnerability to Errors

One of the main disadvantages of cash deposit machines is the potential for operational errors.

CDMs may need help accepting damaged or folded notes, which can lead to transaction delays or errors. In some cases, machines may malfunction, requiring maintenance that disrupts operations.

These issues can be frustrating for businesses that rely on the machine’s consistent performance. Although CDMs are generally reliable, this vulnerability remains a significant consideration.

2. Lack of Personal Interaction

CDMs offer a highly automated customer experience, which can be a drawback for businesses that value personal interaction with their bank. Some businesses prefer the reassurance and relationship-building from dealing with bank staff directly.

This cash deposit machine drawback is particularly relevant for businesses needing additional guidance or personalized services that machines cannot provide. In cases where businesses require specific banking advice, better solutions may exist than CDMs.

3. Fees May Apply

While many banks offer CDM services free of charge, some may impose fees depending on usage patterns. For businesses that frequently use CDMs, these fees could accumulate and offset the cost savings associated with automated deposits.

Businesses must evaluate these potential costs and determine if the convenience and efficiency of a CDM justify any associated fees. The disadvantage of this cash deposit machine should be carefully considered about a business’s cash handling needs.

4. Limited Functionality

CDMs are primarily designed for cash deposits and may not support other banking functions, such as withdrawals, balance inquiries, or check deposits.

This cash deposit machine disadvantage limits CDMs’ versatility, as they offer only a partial range of banking services.

Businesses that require multiple transaction types may find this limited functionality inconvenient, as it necessitates additional trips to a physical bank branch for non-deposit needs.

Use Cases for Cash Deposit Machines

CDMs offer significant advantages for various types of businesses, particularly those that handle large amounts of cash regularly. Below are some examples of industries where cash deposit machine benefits are especially valuable.

1. Retail Businesses

Retail stores, especially those with high transaction volumes, benefit from CDMs by restructuring cash handling. Making quick, secure deposits during peak hours allows retailers to maintain a steady cash flow without disrupting customer service.

This increases operational efficiency and minimizes the time cash spends on the premises, reducing the theft risk. For retail businesses, CDMs serve as a practical tool to improve cash management and ensure the safety of funds.

2. Convenience Stores

Convenience stores also gain from using CDMs. These stores operate extended hours and often experience high cash turnover, making cash management a priority.

When using CDMs for regular deposits, convenience stores can efficiently handle cash without requiring employees to travel to a bank during shifts.

This cash deposit machine benefit minimizes the risk of holding large sums on-site and boosts the business’s cash flow security.

3. Restaurants and Cafes

Restaurants and cafés typically handle a high volume of cash transactions daily. For these businesses, CDMs provide an efficient solution for managing cash without disrupting service.

Staff can make deposits at the end of each shift or during quieter hours, a reformation of the end-of-day cash handling process.

This cash deposit machine advantage allows restaurants to focus on customer service while ensuring that cash is securely deposited and accounted for.

Conclusion

Cash deposit machines offer a range of advantages and disadvantages that make them a valuable tool for some businesses, while others may find the potential drawbacks significant.

On one hand, the cash deposit machine benefits include convenience, increased security, reduced labor costs, and efficient deposit processing.

These features make CDM ideal for businesses that handle large cash volumes, allowing them to align operations and improve cash flow management.

On the other hand, the cash deposit machine’s drawbacks, such as vulnerability to operational errors, limited functionality, and potential fees, highlight some limitations that businesses should consider.

Ultimately, businesses should evaluate the pros and cons of cash deposit machines based on their unique cash handling needs, operational requirements, and customer interaction preferences.

For many, CDMs represent a reliable, secure, and efficient solution to cash management, while for others, traditional banking methods or a combination of both may be more suitable.

When weighing these factors, businesses can decide whether CDMs are the right fit for their operations.

BOOK A FREE DEMO